Stock Market Futures for Tomorrow: What They Tell You

Introduction

Ever wondered how traders and investors get a feel for the next day’s market before it even opens? The answer lies in stock market futures. These futures contracts trade outside regular hours and offer a sneak peek at market sentiment for tomorrow. In this post, we’ll explore what stock market futures mean, how to read them, and how to use them to anticipate tomorrow’s trading tone.

What Are Stock Market Futures?

Stock market futures are contracts that represent the expected future value of stock market indices like the Dow Jones, Nasdaq, or S&P 500. They trade almost 24 hours a day and are often used by traders and institutions to hedge or speculate on future market movements.

They’re especially useful after market hours, when regular stock trading is closed.

Why Look at Futures for Tomorrow’s Market Outlook?

Futures prices react to:

- Overnight news

- Global market moves

- Economic reports

- Earnings releases

- Political or geopolitical developments

This makes them a powerful tool for estimating how markets may behave at tomorrow’s open.

Where to Track Futures for Tomorrow

Here are reliable platforms to check futures data before the next trading day:

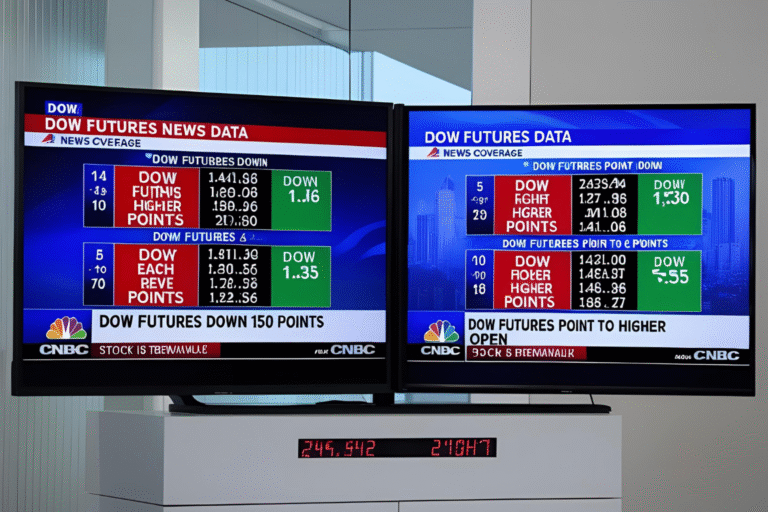

- CNBC Pre-Markets Page

- Real-time Dow, Nasdaq, and S&P futures

- Clean layout, updated frequently

- Visit: https://www.cnbc.com/pre-markets/

- TradingView

- Advanced charting tools

- Watch futures react to real-time news

- Visit: https://www.tradingview.com/

- Investing.com

- Futures prices plus news, earnings calendars, and technical signals

- Visit: https://www.investing.com/

- Yahoo Finance

- Displays futures alongside major indices and pre-market stock movements

- Visit: https://finance.yahoo.com/

How to Interpret Futures Movements for Tomorrow’s Market

Here’s what different futures trends might suggest:

- Futures Up Strongly (+100 points or more):

Expect a bullish open unless major news reverses the mood. - Futures Down Significantly (-100 points or more):

Indicates a bearish tone, possibly due to bad news or weak data. - Flat Futures (±30 points):

Suggests a quiet or neutral open unless something breaks overnight.

But remember: futures are not guarantees. They reflect current sentiment, not certainty.

When Do Futures Start Indicating Tomorrow’s Market?

Futures begin trading Sunday at 6:00 PM EST and run continuously until Friday at 5:00 PM EST.

For tomorrow’s market direction, watch futures:

- After the current day’s close (4:00 PM EST)

- In early morning pre-market hours (6:00–9:00 AM EST)

These are the best windows to assess how the next day might begin.

Using Futures to Plan Trades for Tomorrow

Traders use futures to:

- Adjust positions before market open

- Avoid surprises from overnight news

- Spot early momentum in key sectors

- Manage risk based on volatility signals

Futures give you time to prepare, instead of reacting blindly at the opening bell.

Conclusion

Stock market futures for tomorrow are a valuable tool for gauging where the market might open next. While they don’t predict the future with certainty, they provide a powerful look at market mood, especially during overnight hours. Whether you’re a trader or a long-term investor, checking futures data can help you start your day with confidence.

FAQs

Q1. What do stock market futures tell you about tomorrow?

They reflect how traders expect the market to perform at the next opening, based on current news and events.

Q2. Can futures be wrong?

Yes. Futures show current sentiment, but major overnight news can quickly shift expectations.

Q3. When is the best time to check futures for tomorrow’s market?

Check after 6 PM EST (post-close) and again early in the morning before the market opens.

Q4. Should beginners trade based on futures data?

Futures are best used as a signal—not a sole reason—to trade. Combine with other analysis.

Q5. Do futures always move the same way as the actual market?

Not always. They usually indicate direction but can diverge due to breaking news or technical factors.