Beginner’s Guide to Trading Dow Futures: How to Get Started

Introduction

Interested in trading the stock market but not sure where to begin? Trading Dow futures might be a great starting point. These contracts let you trade the future direction of the Dow Jones Industrial Average—one of the most watched indices in the world. In this guide, we’ll break down what Dow futures are, how to trade them, and tips to avoid common beginner mistakes.

What Are Dow Futures?

Dow futures are agreements to buy or sell the DJIA index at a future date for a predetermined price. Instead of trading individual stocks, you trade the entire Dow index, which represents 30 major U.S. companies.

Dow futures are:

- Traded electronically almost 24 hours a day

- Available in multiple contract sizes (standard, E-mini, Micro)

- Used by traders to profit from both rising and falling markets

Why Trade Dow Futures?

Here are some reasons why Dow futures are popular among traders:

- Leverage: Control a large position with a smaller margin.

- Flexibility: Trade long or short, depending on market view.

- Liquidity: High trading volume means easy entry and exit.

- Around-the-clock access: Respond to global news even after U.S. markets close.

Types of Dow Futures Contracts

- Standard Dow Futures (Large contract)

- Mostly used by institutions.

- High notional value.

- E-mini Dow Futures (YM)

- Most popular among retail traders.

- Contract size: $5 x Dow Index.

- Micro E-mini Dow Futures (MYM)

- Great for beginners with smaller accounts.

- Contract size: $0.50 x Dow Index.

How to Start Trading Dow Futures

- Choose a Futures Broker

Look for brokers like:- Interactive Brokers

- TD Ameritrade (ThinkorSwim)

- NinjaTrader

- TradeStation

- Fund Your Trading Account

- Most brokers require a minimum margin balance ($500–$2,000+ depending on contract type).

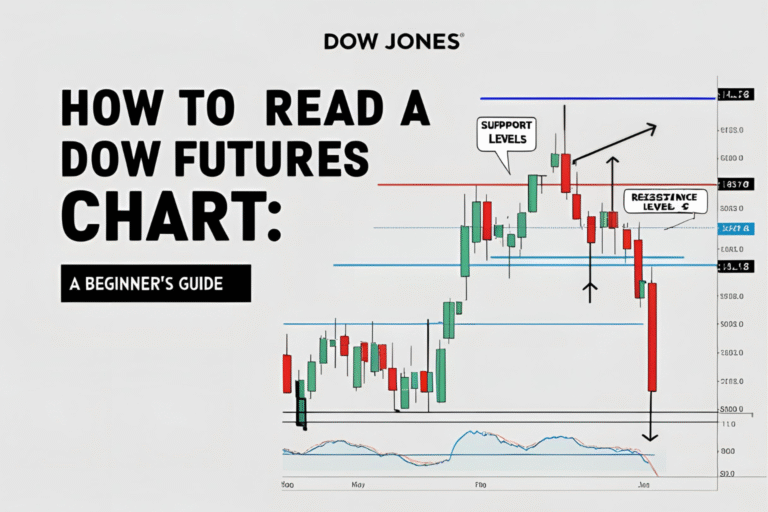

- Use a Trading Platform

- Select one with real-time data, charts, and order types.

- Practice with a demo account first.

- Understand Margin and Leverage

- Futures allow you to trade with borrowed funds.

- Know your risk—leverage increases both gains and losses.

- Place Your First Trade

- Start with a Micro E-mini contract.

- Monitor price, set stop-loss, and follow your plan.

Best Practices for Beginners

- Start small: Use Micro E-minis and keep your position size modest.

- Always use a stop-loss: Protect your capital from unexpected market swings.

- Stick to a plan: Don’t chase the market or overtrade.

- Track economic news: Futures often move ahead of announcements.

- Journal your trades: Learn from every win and loss.

Conclusion

Trading Dow futures can be a powerful way to get involved in the financial markets. With lower capital requirements, flexible strategies, and nearly 24-hour access, they offer opportunities for traders of all levels. But success starts with knowledge, discipline, and a focus on managing risk. Start slow, stay informed, and keep practicing.

FAQs

Q1. How much money do I need to start trading Dow futures?

You can start with as little as $500–$1,000 if using Micro contracts, but more capital allows for better risk management.

Q2. Can I trade Dow futures at night?

Yes, they trade nearly 24/5, starting Sunday evening through Friday evening (U.S. time).

Q3. Are Dow futures good for day trading?

Yes, many traders use E-mini and Micro contracts for intraday strategies.

Q4. What’s the easiest way to learn Dow futures trading?

Open a demo account, study price charts, and follow a trading journal.

Q5. Are futures riskier than stocks?

They can be. Futures use leverage, so you can lose more quickly if you don’t manage risk properly.